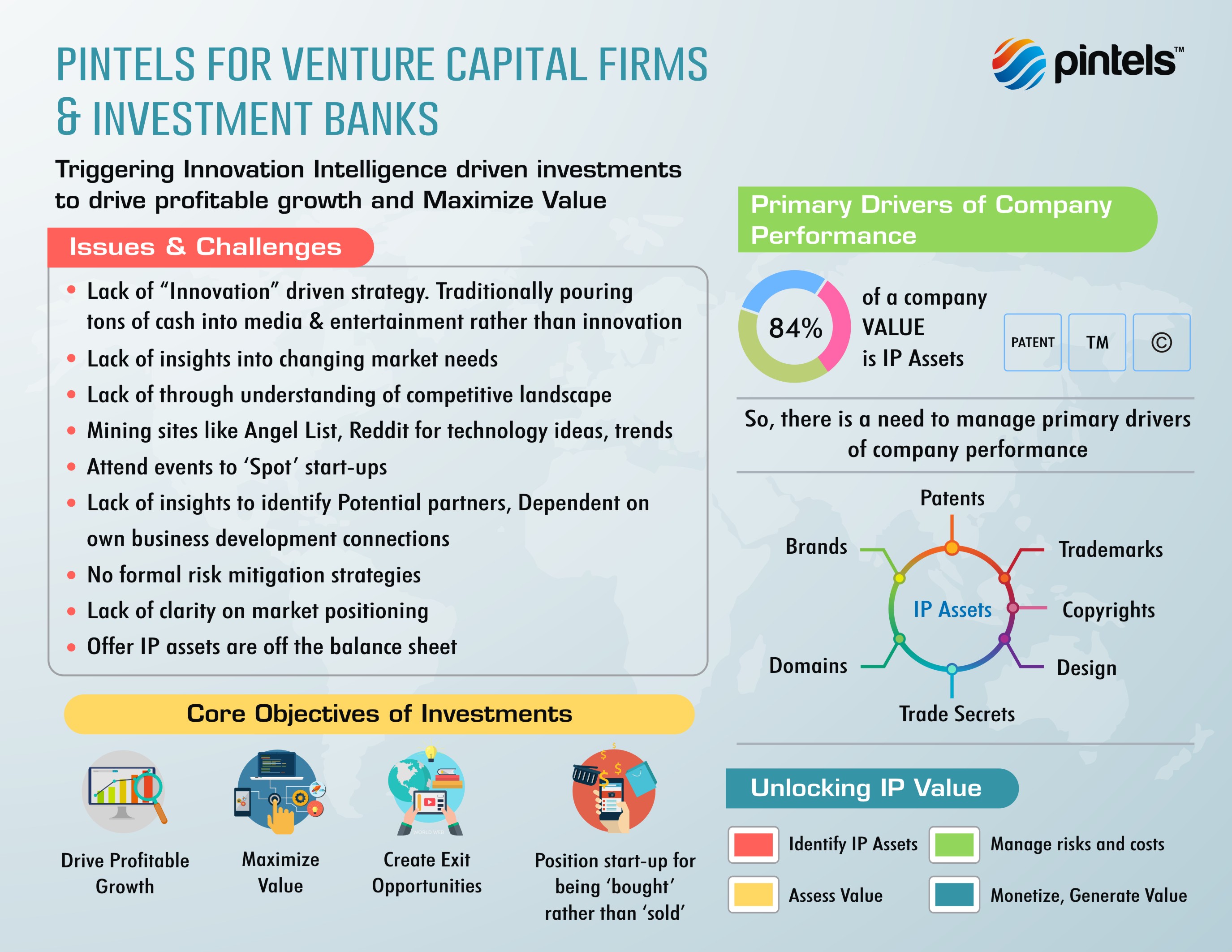

Why Pintels for Venture Capital Firms and Investment Banks?

It is mainly for Triggering Innovation Intelligence Driven Investments to drive profitable growth and Mximize Value

Some of the issues and challenges faced are presented below:

-

Lack of Innovation driven strategy. Traditionally pouring tons of cash into media & entertainment rather than innovation

-

Lack of insights into changing market needs

-

Lack of thourough understanding of competetive landscape

-

Attend events to "spot" Start-ups.

-

Mining sites like Angel List, Reddit for technology ideas, trends

-

No formal risk mitigation strategies

-

Lack of clarity on market positioning

-

Offer IP assets are off the balance sheet

-

Lack of insights to identify potential partners, dependent on own business development connections.

Core Objectives of Investments

-

Drive Profitable Growth

-

Maximize Value

-

Create Exit Opportunities

-

Position Start-up for being 'bought' rather than 'sold'

Download Pintels for Venture Capital Firms and Investment Banks Infographic

Common Issues and How to leverage Pintels to Address them

-

Manage Technology Innovations is single most important driver of competitive success

-

Understand Technology planning, technology roadmap and strategic roadmaps and align them

-

Manage innovations and technologies from technology domains and technology fields under one roof, that is on common platform

-

Help you manage competitive benchmarking to leapfrog against competition

-

Manage strategic risks

-

Identify emerging technologies and opportunities

-

Detect threats

-

Perform Competitive Benchmarking at Strategic, Functional and Operational levels

Want to understand and know more about Strategic Technology Management!. Engage with our innovation and subject matter experts to understand your business needs adapt pintels strategic technology management to drive profitable growth and accelerate value.